I’ve been a full-time freelancer for over three years and in that time, I’ve changed from being quite shy about the topic of money and charging clients to being very upfront and realistic but, even now, one of the hardest concepts is cash flow management.

No-one ever really talks to you about cash flow before you go freelance and whenever I’ve worked on-site at agencies, the attitude from some in-house developers is that freelancers are coining it in. Whilst it is true that you can make more more by freelancing the fact that your cash flow is so up and down means that if can rarely feel that way.

In fact, I’ve met lots of people on the cusp of going freelance who haven’t saved up at all and haven’t realised that their first freelance payment may be months away.

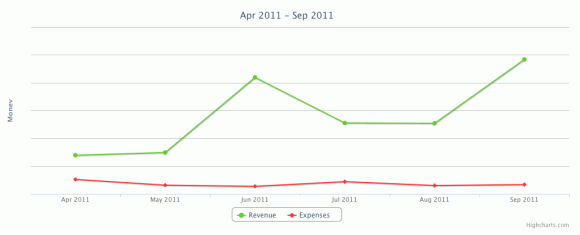

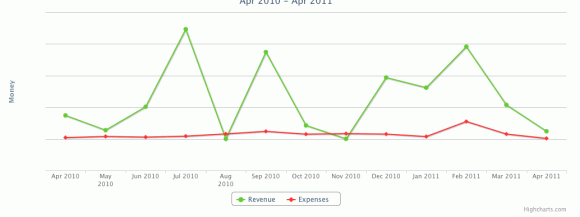

My revenue and expenses for the past 3 tax years

See those big green spikes? They’re the good times; they represent the fruition of month’s of hard work; times when I went for celebratory meals at (slightly) expensive restaurants with people I loved. However, those green troughs represent some of the worst moments of my life; times when I was working really hard but knowing I would not receive a penny for months to come; times when I was buying Smart Price beans in ASDA and wondering if I’d be able to pay the mortgage that month.

Payment terms

Most companies have payment terms of 30 days. That means, that 30 days after you complete the job you get paid. If the job takes one month then this means you get paid a full two months after starting the job. Some businesses have payment terms of 45 days, 60 days or more and honestly, if you can avoid working for these guys then do.

However, if you can negotiate them down to 30 days or lower than that’s great and, yes, it can be done because I have done it with some of Manchester’s most notorious agencies.

In reality 30 day terms means, that after 30 days your client’s accounts department will tell you:

- they never received the invoice or they lost it so you need to resend it

- you just missed the payment run but there’s another one in 30 days

- the guy who pays the invoices is on holiday this week and will be back in next week

It’s important to remind accounts people at least a week before your invoice is due so those excuses don’t get trotted out on the day the invoice is due.

Improving cash flow

One of the ways that I’ve attempted to try and sort out my cash flow is to start taking upfront payments of (usually) 50% for larger scale jobs – that is to say jobs that will take a month or longer. In fact, when working with direct clients I try to do this for all jobs regardless of size/duration.

Also, I try to request payment terms of 15 days maximum. A lot of the time, I have no say over this as clients often dictate the payment terms and don’t allow me to shorten them but, sometimes, as mentioned previously, they do so it’s always worth trying.

If I work with digital agencies for day-rate priced projects spanning months then I often ask to invoice at the end of every month. When I first started out I’d wait until the end of a 3 month project then invoice – which was foolish of me.

The other way to manage cash flow is to maintain a sizeable cash reserve in my business bank account. Personally, I try to keep 3 month’s minimal pay in there at all times so I can survive for 3 months if the worst (or let’s face it the usual) happens. Of course, doing this means I’m constantly squirrelling away money as opposed to spending it on anything. My bank manger probably loves me.

Good clients

There are some direct clients and digital agencies who are fantastic payers. These people pay on time without have to be strong-armed or sweet-talked into doing so. In return, they get first refusal on my time, they get preferential treatment and they get respect. It’s important to find yourself clients like this – they do exist.

Paying yourself

Another mistake I made when starting freelancing was to pay myself as and when I got paid by clients. Now however, I try to treat myself as an employee and pay myself the same amount at the same time each month. This is really difficult to do but very important to maintain a level of stability and realism in my life.

Summary

3 years in and I still struggle with cash flow from time to time. It does get easier but I think it will always be an issue as a small business owner.

Are you a freelancer or a small business owner? Do you have any tips for managing your cash flow that you’d like to share in the comments or tweet to me @imgiseverything?

Absolutely awesome post Phil!

I’m totally in the same boat, I’ve been starring at a very similar graph of revenue & expenditure for the past three years. You make some great points about negotiating payment terms, making sure you chase payment early and keeping that 3 month buffer in your reserves.

The sure-fire way for a client to get top of my priority list is to pay on time and with no hassle. (No cheques! please!)

For direct client’s then getting half up front is very much advisable.

I’m the same as you, I’m constantly trying to squirrel that safety buffer away too. As you know Its not just for when you don’t have work, I think in-house people also forget that the buffer is for things like Illness, Holidays (We need them too!) and to deal with the sadly all too often late payments.

My biggest piece of advise is to be sensible with your personal finances. Keep a spreadsheet of your monthly outgoings, work what you “need to live” and pay yourself so that you cover the NTL + about a third to be your disposable income (DI). Keep that roughly same each month no matter how much you earn and then at the of the year you can either have a nice bonus or in the worse case you wont be struggling as much as might.

Nice write-up, some very valuable pieces of advice in there.

One thing I’ve taken to doing – sort of a modified version to your ‘pay yourself every month’ approach – is to avoid squandering money when it first comes into my bank account: always a temptation when a large invoice comes into your bank account.

Like you, I keep hold of as much money as possible in savings/business account to overcome the quieter periods, but I base the amount my company ‘pays’ me each month on the amount I used to earn as a full-time member of staff in a city-centre agency; it’s not a massive amount, but it’s an amount I know I can live comfortably on, and unless I’ve worked less than two weeks out of that month, I will still have more left over adding to that ‘rainy day’ pot.

It works really well for me because I’m able to see exactly how many months I can survive without reducing the amount coming into my personal bank account each month if – in the very worst case – I end up not working for extended periods of time. I injured my arm earlier this year and was unable to work for six weeks – being incapacitated should be any freelancer’s worst nightmare – fortunately I had enough stashed away (and still incoming from unpaid invoices) to see me through but if – as I did when I first started – I had spent the invoice amounts as they came in, I would have been in a very grave situation indeed.

The biggest mistake a new freelancer can make with cashflow is to assume that the money will always be coming in and that they can spend those first few invoices as the money comes in.. Your graphs do a very good job of illustrating just how up-and-down it can be!

Insightful article Phil! I’ve been thinking of freelancing myself recently and never really gave any thought to company payment terms, which no doubt would have sunk me instantly were I to do work for a company that had a lengthy one.

This has given my something else to take into consideration before I embark upon my freelancing quest. Thank you.

Love it. I wish more people would share this kind of honest overview of some of the pitfalls of freelancing. Lovely to be reminded that other people are jumping through the same hoops as me.

Something I’ve started doing recently is asking for prepayment on smaller jobs. It saves wasting time and effort chasing up a days work thirty or forty days after I did it. It doesn’t always work but when it comes off it can be a great help to cash-flow problems.

Really good posting. I’ve been freelancing 18 months and was hoping that the peaks and troughs might even out one day but looks like they won’t. Just this morning I’ve sent out emails to 2 very good clients who are overdue on invoices – they all do it, no matter how big the agency is. I’ve started sending the invoice out the minute I finish the job which helps. Still, after working for design agencies for donkeys years, freelancing is great.

Hi Phil

Having recently gone back to freelance, I gave some thought to payment terms. Theoretically, you are the one who lays down the terms as you are invoicing them. The agency/clients terms are irrelevant.

As you are providing a service there is no reason to not get paid on completion (known as payment on account).. shouldn’t need to wait 7, 14, or 30 days.

Well, that’s the theory. The reality is everyone has to manage cashflow, including the client. Like you, I expect to be fobbed off/delayed with payment, so my strategy is as follows:

– Invoice monthly

– State (nicely) that full payment is required within 14 days

– Attach my T&Cs which include terms relating to interest being applied to late payment.

You are within your legal rights to charging a whacking percentage for late payment

http://www.businesslink.gov.uk/bdotg/action/detail?itemId=1073792170&type=RESOURCES

Not that you’d want to do this, but it means that on day 15, you can start hassling for settlement and hope to get paid within 30 days

You only need to attach your T&Cs on the first invoice.. unless you change your terms

If you don’t get paid, re-issue the invoice with interest requesting immediate payment; stop any further work. If they value you, they will rectify matters. Chances are the person in charge of finance is not the person that hired you. If the hirer values you, they should remove any obstacles.

BTW, Im using Crunch accounting.. helps me manage cashflow as it shows what I owe in Corp Tax etc. and lets me know what I can safely draw as salary or dividend

I feel that I am blessed, for my invoice states “payment upon receipt” and none of my clients have complained about it. Sometimes I think it is up to us to dictate the terms of the working relationship up front to define expectations, though I understand there are industry standards. It is a tough balance. For me *personally*, I would choose not to work with clients who cannot accept my payment terms – but that is after years of building up my portfolio of work.

That being said, it is still tough for cashflow even payment is upon receipt, because that doesn’t help situations whereby the project is stalling or the client going MIA. ;)

Thanks for all the great replies from people so far.

Great post Phil. I’m 6 years in and haven’t solved it.

I wouldn’t recommend strong arm tactics with accounts departments. They’ll just put you to the back of the queue. Be nice, be polite, jump through hoops but contact them regularly.

I always phone accounts quite quickly to check my invoice is in the system / PO correct / they don’t need statement etc. That sometimes helps.

Your advice about a savings account is great, and one I try to use. And Crunch sounds great too, lots of people on that, think I may have to move accountants….

Cheers

Ian

It’s good that you write about cash flow problems! Too many people just sing the praises of freelancing without mentioning the reality : one can really end up on a financial knife edge!

30 days is way too long to wait for payment! Give them 14 days and state it in small print on the invoice! Something like ‘payment within 14 days without reductions’ put it in slightly fine print just below the amount. (So it’s discreet but is still very clear!)

With good clients you should get paid well within that 14 day period most of the time.

Working directly with clients is best if you can find ’em. For me this is real freelancing. Working through agencies is not the real thing you’re just working for the company :-( like an employee wihile the agency middle man takes his cut. Easy to say, but my advice is avoid agencies like the plague. Go and find your clients yourself this part of real freelancing!

Cheers,

Thanks for your comment Richard. Of course, your contract *should* define your own desired payment terms – the reality is when you’re a small organisation providing services to a larger organisation it is difficult to dictate the payment terms.

I work with agencies a lot and (in my experience) it is a much much easier way to make money as a freelancer because you’re free from roles such as account/client management and project planning, etc leaving you free to get on specific role you enjoy. And the cut you’re talking about agencies taking is definitely true but usually agencies are able to command a higher day rate and attract bigger clients then you as a single person could – therefore you can often make more from agency work… unless, that is, you’re really good.

Great post Phil. I’m just moving into freelance consulting. I had a little dab at it about 6 months ago, and this was the first thing that I realised I would have to face.

I’ve implemented a lot of the same measures that you have for some of the projects I have completed recently; however another tip that I can give is consider passive income or retainers. You can “attach” or affiliate yourself with certain providers in delivering your project to your clients. For example, someone freelancing in web projects could offer to provide hosting, as a reseller, and in a way where the hosting company still takes responsibility for technical support. If you have a 100 or so clients in a year and you’re making even £2 per client as a mark-up on the hosting fee, that’s an extra £200/month towards your cashflow (guaranteed), every single month.

Also consider tax incentives and tax laws. Getting the right accountant, or even better learning how you’ll be taxed and managing that legitimately will help you retain more at the end of the year.

Just some quick tips that I can think of. If i think of anymore, I’ll let you know.

The trick is just to always have some buffer (sounds obvious and simple, but hard to manage, maintain and keep up);

Also: (as mentioned) split payment in tranches, like 33% * 3 or similar.